- The Chexy Rundown

- Posts

- 💸 Are Amex Cards Still Worth the Annual Fees (and Hype)? We Break It Down

💸 Are Amex Cards Still Worth the Annual Fees (and Hype)? We Break It Down

From everyday spend to welcome bonuses, here’s the math on which Amex cards make sense, and how using Chexy can boost your points. Plus, earn Aeroplan points on your rent with our new partnership with Fitzrovia.

In This Issue:

💳 Are Amex Cards Still Worth Their Annual Fees?

🔗 Prince’s Corner:

🛫 Chexy Deals: Business Class to Europe + Asia from YYZ, YUL, & YVR

🚀 Introducing Fitzrovia x Chexy: Earn Aeroplan Points on Your Rent

Paying rent just got way more rewarding. We’ve partnered with Fitzrovia, one of Canada’s largest rental developers, to give residents in Toronto and Montreal the chance to earn Aeroplan points every month simply by paying rent through Chexy.

New and renewing tenants can earn points on lease sign-ups, ongoing rent, and renewals. Use an Aeroplan co-branded credit card, and you could earn up to 3 points per $1 at select properties. Depending on your unit type and community, you could rack up 150,000 to 250,000 Aeroplan points in your first year: enough for multiple business-class flights, hotel stays, or vacation packages.

This first-of-its-kind partnership makes rent more than just a monthly expense. It’s the best way to turn your everyday payments into real travel rewards.

To get started, visit chexy.co/fitzrovia and start earning points month after month.

Terms and conditions apply.

💥 Win 100,000 Aeroplan Points with Chexy!

Turn your everyday bills into your next adventure. Chexy is giving away 200,000 Aeroplan Points to three lucky users:

1st Prize: 100,000 points

2nd Prize: 70,000 points

3rd Prize: 30,000 points

How to enter:

Every $500 in new bill payments = 1 contest entry

Refer a friend who completes $500 in payments = 1 bonus entry

There’s no limit to the number of entries: pay more bills, get more chances to win!

What you could do with 100,000 points:

Multiple round-trip flights across North America

Business class tickets to Europe

Mix-and-match trips with flights, hotels, and car rentals

Contest ends December 12, 2025, and points are credited within 60 days.

Terms and conditions apply.

🚀 Love Chexy? Come Work with Us!

We’re looking for a Customer Support Representative to join the Chexy team. If you thrive in a fast-paced, ever-changing environment and enjoy helping people, this is your chance to shape the future of our platform while supporting the users you already know and love.

💳 Are These Amex Cards Still Worth Their Annual Fees? We Break It Down

As we saw a few weeks ago, American Express bumped up the Cobalt card’s monthly fee earlier this month, from $12.99 to $15.99 (or $150 to $191.88 annually in Quebec), putting it much closer to the Gold card’s annual fee of $250.

If you’re thinking of applying for or keeping your Cobalt, it’s worth comparing how it stacks up against some other popular Amex cards.

Here’s a quick breakdown on the Cobalt, Gold, Platinum, and AP Reserve, and our take on whether these cards are still worth the rising annual fees. 👇

Amex Cobalt Card

Annual fee: $191.88 or $15.99 monthly

Points earning: 5x on dining out, food delivery, & groceries, 3x on streaming subscriptions, 2x on gas, transit, & rideshare, 1x on everything else

Welcome bonus: Earn up to 15,000 points (earn 1,250 points when you spend at least $750 each month for one year)

Best for: Everyday earners who spend big on dining out, food delivery, groceries, and streaming subscriptions

If most of your spending goes toward groceries and dining out, the Cobalt is one of the best earners in Canada, even with the fee increase. It’s ideal if you want strong everyday rewards, and the $15.99 monthly fee doesn’t feel that huge in comparison to a card like the Platinum. Since the points convert 1:1 to Aeroplan, it’s surprisingly powerful for travel redemptions.

Amex Gold Rewards Card

Annual fee: $250

Points earning: 2x on travel, gas, grocery, & drugstore purchases, 1x on everything else

Welcome bonus: Earn up to 60,000 points (earn 5,000 points for each month when you spend $1,000)

Best for: Balanced spenders who want some luxury without the Platinum fees

The Gold Card is a solid step above the Cobalt, but only if you’re willing to trade in the 5x earn category for a few travel benefits, like 4 free lounge visits with Plaza Premium, Priority Pass access, and a $100 annual travel credit. If you travel a few times a year, the annual fee can easily pay for itself, making it a smart upgrade if you’re a mid-range spender.

Amex Platinum Card

Annual fee: $799

Points earning: 2x on travel, dining, & food delivery, 1x on everything else

Welcome bonus: Earn up to 100,000 points (earn 70,000 points after spending $10,000 in the first 3 months; earn 30,000 points when you make a purchase between month 15 and 17)

Best for: Frequent travellers who want luxury perks and lounge access

The Platinum Card is all about lifestyle and travel convenience, with a $799 annual fee that’s worth it only if you take full advantage of its perks: travel credits, insurance, airport benefits, and lounge access. Amex used to offer unlimited lounge access, but with a recently changed policy, unlimited entry now requires $20,000 in annual spending. For most Platinum holders, that’s easy to hit, especially if you use Chexy for large one-time or recurring payments.

Amex Aeroplan Reserve Card

Annual fee: $599

Points earning: 3x Aeroplan points on Air Canada purchases, 2x on dining & food delivery, 1.25x on everything else

Welcome bonus: Earn up to 85,000 Aeroplan points (earn 60,000 points after spending $7,500 in the first 3 months; earn 25,000 points when you make a purchase in month 13)

Best for: Frequent Air Canada travellers

If Air Canada is your airline of choice, the Aeroplan Reserve is hard to beat. It has a steep annual fee, but in our opinion, the perks make it worthwhile: you get unlimited free Maple Leaf lounge access, priority airport treatment, and a free checked bag, plus a suite of travel insurance benefits. It’s also one of the fastest ways to rack up Aeroplan points for premium business class redemptions.

💸 How to Hit the Welcome Bonuses Faster

All of these Amex cards offer big welcome bonuses, but the spend thresholds can sometimes be tough to reach with just your everyday spending. With the AP Reserve and Platinum cards, you need to spend $7,500 and $10,000 in the first 3 months - which might sound unachievable. But that’s where Chexy comes in.

Let’s say you pay $3,000 in rent or other large bills (like income or property taxes, or tuition) through Chexy each month. With the small 1.75% fee, that’s $3,052 monthly or $36,630 each year. Here’s how that adds up in points:

Points from Chexy: 3,052 points per month, or 36,630 points per year

Welcome bonus: In the first 3 months, you’ll spend $9,156 with Chexy. That means you only need to spend under $1,000 on everyday purchases to reach the welcome bonus.

Total first year points: 36,630 from Chexy + 100,000 from the welcome bonus + hundreds or thousands more from your regular spending.

Points from Chexy: 3,815 points per month, or 45,780 points per year

Welcome bonus: In the first 3 months, you’ll spend $9,156 with Chexy, meaning you’ve already reached the first part of the welcome bonus.

Total first year points: 45,780 from Chexy + 75,000 from the welcome bonus + hundreds or thousands more from your regular spending.

Curious how many points you could earn? Use our rewards calculator to see exactly how many points you can stack based on your monthly spend and card.

🤔 So, Are These Cards Really Worth It?

It all comes down to your spending habits and travel goals. Here’s our take:

Cobalt: Great for those who spend a lot on groceries and dining out, as it earns fast on high-spend categories.

Gold: Ideal for balanced spenders who want some travel perks with a reasonable annual fee.

Aeroplan Reserve: Best for frequent Air Canada flyers who want lounge access, priority airport treatment, and premium travel perks.

Platinum: Best for frequent travellers who use lounge access, travel credits, insurance, and other premium perks to offset the $799 annual fee.

💡 Pro tip: With Chexy, even high annual fees ($799, ouch) can pay off. Paying rent, bills, taxes, or tuition with your card makes hitting welcome bonuses much easier and racks up points quickly. Perfect if you travel often or have large recurring expenses. 🤑

💳 Which Amex card do you have (or want to get)? |

Check out these awesome deals you definitely don't want to miss if you're thinking about travelling in the next few months!

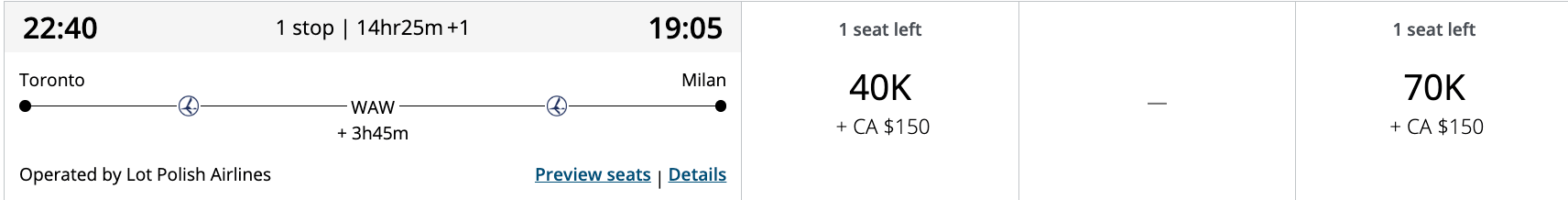

Toronto (YYZ)

Montreal (YUL)

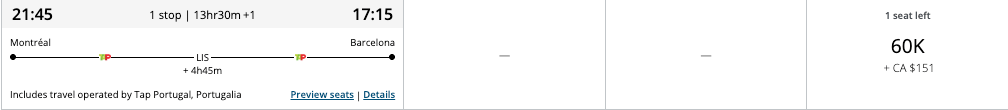

Montreal (YUL) ➡️ Lisbon (LIS) ➡️ Barcelona (BCN)

Cost: 60,000 (Business Class)

Dates: January 21st, 2026

Book: Here

Montreal (YUL) ➡️ Zurich (ZRH) ➡️ Nice (NCE)

Cost: 60,000 (Business Class)

Dates: March 4th, 2026

Book: Here

Vancouver (YVR)

Vancouver (YVR) ➡️ Delhi (DEL) ➡️ Manila (MNL)

Cost: 87,500 (Business Class)

Dates: March 18th, 2026

Book: Here

Vancouver (YVR) ➡️ Delhi (DEL) ➡️ Hong Kong (HKG)

Cost: 87,500 (Business Class)

Dates: April 29th, 2026

Book: Here

Did you like this newsletter? |

Reply