- The Chexy Rundown

- Posts

- 💸 How to Make Tax Season Pay You Back + Hack the Scotia Momentum for Even More Cashback

💸 How to Make Tax Season Pay You Back + Hack the Scotia Momentum for Even More Cashback

From turning your tax bill into rewards to unlocking two 4% cashback caps on the Scotia Momentum Visa Infinite, this issue shows how to make your biggest bills work for you.

In This Issue:

🏦 Tax Season is Coming Up. Here’s How You Can Benefit from It

💳 Hack the Scotia Momentum 4% Cashback Card for Even More Cash Back

🛫 Chexy Deals: Business Class to Europe + Asia from YYZ, YUL, & YVR

🚀 Love Chexy? Come Work with Us!

We’re looking for people to join the Chexy team. If you thrive in a fast-paced, ever-changing environment and enjoy helping people, this is your chance to shape the future of our platform while supporting the users you already know and love.

🇨🇦 ENDING SOON: Earn up to 5,000 Aeroplan® Points with Chexy!

This is your final reminder - our Aeroplan bonus offer ends January 31st, 2026. If you’re already paying rent, bills, tuition, or taxes, this is one of the easiest ways to earn extra Aeroplan points on payments you’re making anyway.

Here’s how you can earn up to 5,000 bonus Aeroplan points:

1,000 points when you create a Chexy account, link your Aeroplan account, and complete your first payment

3,000 points after processing $3,000 in payments through Chexy

1,000 points for completing 12 consecutive monthly payments

Plus, earn a bonus 1,000 points for each person you refer to Chexy.

Log in to your Chexy account to check your eligibility and connect your Aeroplan® account before the offer expires.

Ends January 31, 2026. Learn more here.

Terms and conditions apply.

🏦 Tax Season Is Coming Up Soon. Here’s How You Can Benefit from It

The April 30th tax filing deadline might feel far away, but it’s worth thinking about in advance. If you plan ahead, you can turn a required payment into cashback or travel rewards instead of a pure loss. Yes, it’s possible to actually earn something back from your big tax payment. And we’ll show you how.

Last year alone, Chexy users earned millions of dollars in rewards value just by paying taxes and bills they already had to pay with their credit card. No extra spending, no lifestyle changes. Just smarter payments.

Here’s what that can look like in real life. 👇

💸 Example #1: Scotia Momentum Visa Infinite (for Cashback lovers)

Widely known as one of the best cashback cards, the Scotia Momentum Visa Infinite earns 4% cashback on recurring bills (up to $25,000/year), including tax payments made with Chexy.

Let’s say you pay $7,000 in income tax (based on Chexy internal averages):

Total charged with Chexy fee (1.75%): $7,122.50

Cashback earned at 4%: $284.90

Chexy fee paid: $122.50

Net cashback: $162.40 of free money

Add in the welcome bonus of 10% cashback on all purchases (up to $2,000), and that’s another $200 you’re getting back.

Total cashback from paying taxes: $362.40 - just for paying a bill you already owed.

✈️ Example #2: Amex Aeroplan Reserve (for Air Canada fans)

If you prefer points over cashback and are a frequent flyer with Air Canada, the Amex Aeroplan Reserve is for you.

You can just about reach the welcome bonus with this one $7,000 tax payment, and earn points on the spend itself. Here’s what that looks like:

Total charged with Chexy fee: $7,122.50

Earn rate: 1.25x Aeroplan points

Points earned from taxes alone: 8,903 points

Now layer in the welcome bonus:

60,000 points after spending $7,500 in the first 3 months

25,000 points when you spend $2,500 in month 13

That’s 85,000 bonus points, which you can realistically earn by combining your tax payment with normal, everyday spending.

Total points earned: 93,903 Aeroplan points

And that’s before everyday spending, travel purchases, or bonus categories. Using this card for bills, rent, and everyday purchases, you can easily rack up over 100,000 points in the first year.

👀 Looking for some great ways to use those points? Scroll to the bottom of this newsletter for some amazing Aeroplan business class redemptions from Toronto, Montreal, and Vancouver.

💸 Why Paying Taxes with a Credit Card Just Makes Sense

Beyond the points and cashback, there are a few underrated perks of paying your income tax with a credit card and Chexy:

Earn rewards on a massive payment - and easily hit welcome bonus requirements

Higher earn rates - Chexy classifies tax payments as recurring, unlocking better rewards on some cards

More flexibility - pay by credit card instead of sending large bank transfers or cheques

Better cash flow - you get extra time before the credit card bill is due

Potential credit score boost - as long as you pay it off in full and on time

Remember: only pay your taxes and large bills with a credit card if you already have the cash to pay it off, as interest wipes out the upside fast.

The bottom line? Taxes are inevitable, but missing out on rewards doesn’t have to be. With the right card in your wallet and a bit of planning, your biggest bill of the year can actually work in your favour.

💳 How to Hack the Scotia Momentum Visa Infinite for Even More Cashback

Big bills add up fast. If you’re using the Scotia Momentum Visa Infinite to pay for recurring expenses like rent, taxes, or tuition, there’s a good chance you’re hitting the $25,000 annual cap on its 4% cashback categories sooner than you think.

Instead of letting your earn rate drop to 1% for the rest of the year, there’s a smarter move most people don’t know about: apply for a second Scotia Momentum Visa Infinite. Seriously. It’s allowed, and it works. Let’s dive into the math of exactly how much you can get back.

🤑 The Details

This card earns 4% cashback on recurring bills and groceries (up to $25,000 per year). Once you hit that cap, the earn rate drops to just 1%. But with two cards, you can double that cap:

Card #1: 4% on the first $25,000

Card #2: 4% on another $25,000

That’s $50,000 earning 4% cashback (before fees) every year.

Now let’s talk about what actually matters: what you take home after Chexy fees. When you pay bills through Chexy, your earn rate is 4% - 1.75% (Chexy fee) = 2.25% net cashback.

Real-Life Example

Let’s say your rent is $2,000 per month.

Annual rent: $24,000

Net cashback at 2.25%: ~$540 back per year

That’s just rent.

Now imagine you put all your other recurring bills (like daycare, utilities, gym memberships, and insurance payments) on the second Scotia Momentum VI card. Those expenses continue earning another 2.25% net cashback after fees (until you hit $25k), instead of dropping to 1%.

And let’s not forget the welcome bonus: for the first card only, you’ll get an extra 10% cashback on all purchases for the first 3 months (up to $2,000), meaning you’ll earn another $200.

By maxing out the 4% categories across two cards, you’re earning 2.25% net cashback after fees. On $50,000 in recurring bills, that works out to about $1,125 back, plus $200 from the welcome bonus, for roughly $1,325 in net cashback in year one.

And the best part? The $120 annual fee for both cards is waived in year one. 👏

🧠 How Chexy Makes This Even Better

Since you’re likely paying your large bills with the Scotia Momentum and Chexy, listen up: you can now add up to 5 different cards to your Chexy wallet.

This means if you hit the $25k cap on card #1, you can switch to card #2 and keep earning 2.25% net cashback on another $25k.

And if you apply for the Scotia Momentum Visa Infinite and plan to use it with Chexy, show us proof of approval, and we’ll waive your Chexy fee for the first month.

The Bottom Line

If you’re already spending big on recurring bills, this is one of the easiest cashback “hacks” out there, with no extra spending required. And think about what you could do with the extra money - cover a flight (or two), offset part of your tax bill, put it in savings… the options are endless.

Check out these awesome deals you definitely don't want to miss if you're thinking about travelling in the next few months!

Toronto (YYZ)

Toronto (YYZ) ➡️ Paris (CDG)

Cost: 64,700 (Business Class)

Dates: February 19th, 2026

Book: Here

Toronto (YYZ) ➡️ London (LHR)

Cost: 60,000 (Business Class)

Dates: February 24th, 2026

Book: Here

Montreal (YUL)

Montreal (YUL) ➡️ Barcelona (BCN)

Cost: 64,700 (Business Class)

Dates: February 16th, 2026

Book: Here

Montreal (YUL) ➡️ Madrid (MAD)

Cost: 64,600 (Business Class)

Dates: February 18th, 2026

Book: Here

Vancouver (YVR)

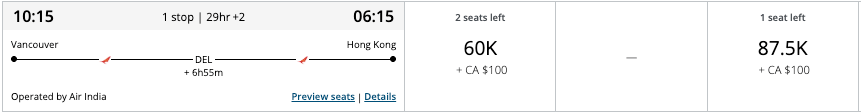

Vancouver (YVR) ➡️ Delhi (DEL) ➡️ Hong Kong (HKG)

Cost: 87,500 (Business Class)

Dates: May 16th, 2026

Book: Here

Vancouver (YVR) ➡️ Delhi (DEL) ➡️ Manila (MNL)

Cost: 87,500 (Business Class)

Dates: May 28th, 2026

Book: Here

Did you like this newsletter? |

Reply